The Blueprint for Business Financial Success

Every business, whether just starting out or well-established, requires a robust plan to ensure its viability and success. But a business plan isn’t enough. A keen understanding of financial management will expose weaknesses, highlight strengths, and ensure strict adherence to that plan.

The $500,000 Spreadsheet: Why Your Financial Reports Are Lying to You

Here’s a truth that’ll make your accountant uncomfortable: that pristine P&L statement sitting on your desk? It’s not telling you the truth. It’s telling you history – and worse, it’s presenting that history through a lens designed for tax compliance, not strategic decision-making.

Most SME owners are flying blind at 500 mph while staring at their rear-view mirror. They call it “financial management.” I call it expensive hope dressed up in Excel formatting.

When we review past performance to project future actions, we’re laying the foundation for our upcoming business decisions. Yet, merely relying on past results won’t necessarily propel us to meteoric success. In fact, such a method is incremental at best. Too often, businesses get so enmeshed in the numbers that they lose sight of the broader picture

Unfortunately, predictions based on past outcomes will not challenge us enough and will not produce impossible results overnight. The process alone is slow and demanding and businesses very often lose sight of what is really happening and important.

Most SME owners are flying blind at 500 mph while staring at their rear-view mirror. They call it “financial management.” I call it expensive hope dressed up in Excel formatting.

The external factors are opposite, unpredictable, hectic and sudden, so you have to do all that is in your capabilities to be on the safe side when bad times arrive. You are the captain of your company and you must take responsibilities that go with it. As a business owner, it’s your duty to steer your ship, especially through turbulent waters

Why Your Accountant Might Be Your Biggest Growth Barrier

Controversial statement incoming: Your traditional accountant is probably killing your business growth. Not through malice – through training.

Most accountants are trained historians and compliance officers. They’re exceptional at recording what happened and ensuring you don’t go to jail. Strategic growth? That’s not in their certification.

The problem isn’t your accountant’s competence – it’s their mandate. They’re optimising for tax minimisation and compliance. You need optimisation to create value and improve strategic positioning. These are fundamentally different games.

This is why the Triangle framework separates “accounting” from “Financial Intelligence.” Accounting records history. Financial Intelligence architects the future. One looks backward through a compliance lens. The other looks forward through a strategic lens.

Your business doesn’t need better historical records. It needs predictive financial architecture that connects yesterday’s data to tomorrow’s decisions. It needs systems that turn numbers into strategic weapons, not just compliance documents.

If your financial advisor can’t explain how your numbers connect to your business model optimisation, you don’t have a financial intelligence partner – you have an expensive scorekeeper.

Sound financial management goes hand in hand with good accounting practices

Sound financial management and good accounting practices are the best ways for your business to remain profitable and solvent. How well you manage the finances of your business, its cash flow and profitability is the cornerstone of every successful business operation.

Now, here’s the truth: Financial management and astute accounting practices are non-negotiables. They’re the bedrock upon which profitable businesses are built. Yet, shockingly, countless promising ventures go under because of financial mismanagement. Inaccurate records, bad advice, unethical strategies, and the bane of many businesses—tax evasion—are all pitfalls to avoid. At the end of the day, we are all humans. And let’s be real: maintaining consistent focus in business is no walk in the park.

Measuring what matters

Sometimes challenges are enormous and we cannot decide on our priorities as well as how to address them. As a business owner, you will need to identify and implement policies and procedures that will lead to and ensure that you will meet your financial obligations and ensure your business will have enough working capital once and when needed. By playing in right here, you are increasing the likelihood of success.

To effectively manage your financial obligations, plan a sound, realistic (not too optimistic, not too pessimistic), but still challenging budget by determining the actual amount of money needed to open your business (start-up costs) and the amount needed to keep it open (operating costs), running and thriving.

As a business owner, you should be aware of the following:

Cash flow issues are weak excuses for not paying attention

Why is it important to monitor your cash flow? It’s the lifeblood of your business. Any surplus should be invested wisely to yield consistent returns. You need the money to fund your weekly cash requirements in the way of everyday business operations, business acquisitions, long-term investments and borrowing serviceability. Whatever extra cash is available should be parked into a high-interest account that will produce constant returns. In that way, you will be motivated to save and weigh your investment decisions, be cautious with your money, take calculated risks and refrain from being tempted to spend it on luxuries.

Your Inventory days are important because you know that slow-moving stock – in other words, not competitive and outdated – cannot bring you funds at the desired level to expand your offerings and grow your operations. It will slow down your growth rate and reduce your turnover. Then your business will decline and suffer because of slow-moving sales figures. Please remember, nothing moves in business if there are no sales. If you take actions to accelerate your stock turnover, your cash flow will improve and your business will be in a much better position to take upon opportunities when they present themselves.

Your Account Receivables days are critical for various reasons. Firstly, slow-paying accounts bring many problems to your business and to you personally. Counting on funds that are not available as promised can be frustrating. In addition, if they are going to be late and you know that your work is already underpriced, it will only add to your pain. There is nothing more frustrating than following up on these accounts, especially when you know that you and your firm completed the requirements in record-breaking time and at the highest quality. Others have problems too but they should not become yours! Attempt to take deposits up front and perform some progress payment practices whenever you deal with historically slow-paying clients. If not successful, consider releasing some potential in your business and refer them to other service providers. You cannot be a solution to everyone with a pulse and a chequebook! Set some standards value what you have and do well! Remember that the first sale in every business is to you!

Accounts Payable Days are as important as Accounts Receivable Days. Imagine, and there is a lot of validation there, that you have slow-paying accounts but at the same time very unfavourable credit terms. You are going to be out of the business in no time!

So please, check these days and negotiate them to suit both sides! Build partnerships, don’t destroy them. Build bridges and help in building their businesses. There are, with the exception that you are a specialised & unique business, numerous suppliers in every industry and they would like to have you on their books. Do not be tied to something that does not suit your plans. Attempt to negotiate the best possible deal out there!

The Cash Flow Paradox: Why Profitable Companies Go Broke

The most dangerous lie in business? “We’re profitable, so we’re fine.” I’ve watched businesses with healthy P&Ls implode because they confused accounting profit with actual cash. It’s the business equivalent of thinking a menu equals a meal.

Here’s what conventional advisors won’t tell you: your bank account doesn’t care about accrual accounting. Your suppliers don’t accept “accounts receivable” as payment. And that brilliant growth opportunity? It requires actual money, not theoretical profit.

The Triangle Intelligence demands this: Financial Intelligence isn’t about tracking what happened – it’s about engineering what happens next. Your numbers should tell you three things: where you’ve been (Financial Intelligence), how efficiently you got there (Systems Intelligence), and whether your team has the capability to accelerate (Human Capital Intelligence).

When these three dimensions align, cash flow becomes predictable. Ignore any leg of the stool, and you’re just hoping gravity takes a day off.

Key performance indicators will keep you focused on things that matter

Other Key Performance Indicators like the number of new customers each month, number of prospects each month, number of prospecting calls you made each month, number of new initiatives you take each month, number of new sales each month, new leads, clicks on your web site, productivity rate, profitability measures, are just as much important and deserve your full attention.

How would you know if the business is optimally managed?

Your Business reporting requirements – accrual or cash accounting as they both have certain benefits and implications. Talk to your trusted advisor as to which is the best reporting cycle in your case and clearly understand your alternatives to choose your preferred options.

Stop Measuring Everything and Start Managing Something

The modern SME owner drowns in data while dying of ignorance. Forty-seven KPIs tracked weekly. Seventeen dashboard tabs. Zero strategic decisions made.

Here’s the uncomfortable truth: most KPIs are vanity metrics masquerading as insight. They make you feel productive while achieving nothing. “Page views are up!” Great. Are profits? “Website traffic increased 40%!” Wonderful. Did revenue? “Customer satisfaction scores improved!” Fantastic. Are customers buying more frequently?

The Effecta Standard: Identify the 3-5 numbers that, if improved, would 10x your business value. Everything else is noise. If your dashboard has more than one screen, you’re not managing your business – you’re managing your dashboard.

Want the real test? If a metric doesn’t directly connect to cash, capability, or competitive advantage, stop tracking it. Your time is worth more than feeding a measurement addiction.

Financial illiteracy may cost you more than you ever expected

You should understand and be financially literate to analyse Profit and Loss Statements and Balance Sheet Statements, and do so every week if possible. I will go one step further and suggest that you must know to obtain and analyse your financial figures weekly (10 minutes only) and if you don’t you are just risking too much.

Once asked what went wrong in his business, Mr Trump responded: “I simply took my eyes off the ball.” You cannot afford not to have a great bookkeeper, a great accountant, a great financial planner, a great business coach, and other service providers that can add value, complement your skills and extend your competitiveness.

You cannot do it all alone without including others in your success story.

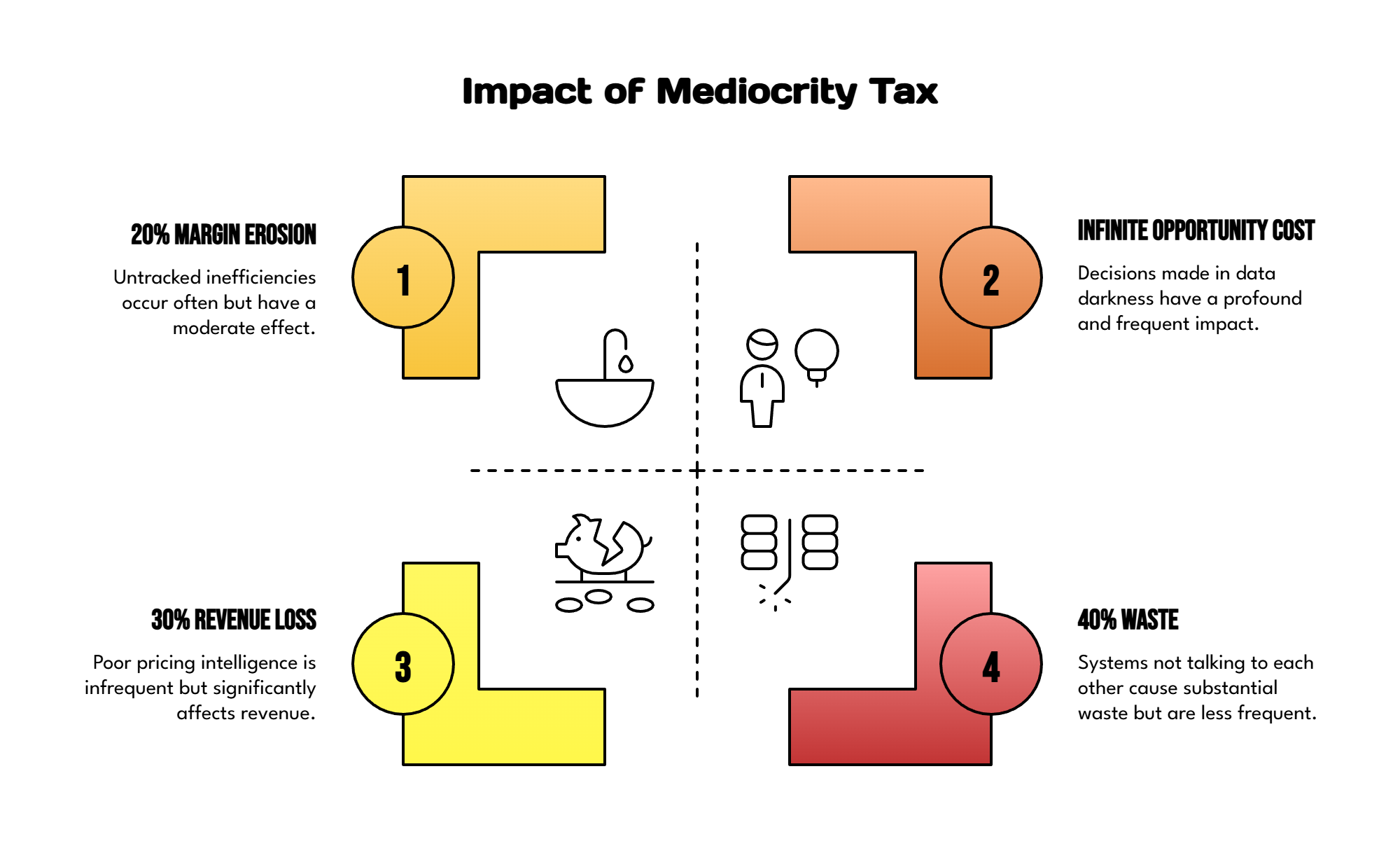

The Mediocrity Tax: What Poor Financial Intelligence Really Costs

Every business pays one of two taxes: the Mediocrity Tax or the Excellence Premium. There’s no middle ground.

The Silent Effect Of Mediocrity Tax

The Mediocrity Tax compounds silently:

- 20% margin erosion from untracked inefficiencies

- 30% revenue loss from poor pricing intelligence

- 40% waste from systems that don’t talk to each other

- Infinite opportunity cost from decisions made in data darkness

Most owners think they’re avoiding the Excellence Premium by keeping things “simple.” Reality check: complexity is happening whether you measure it or not. Choosing to remain ignorant doesn’t make you agile – it makes you vulnerable.

The businesses crushing it aren’t smarter. They’ve just decided that systematic financial intelligence beats heroic financial guessing. Every. Single. Time.

How do you price your services or products?

An effective pricing mechanism for your products and services is important, as it sets your growth rate, structures your profit planning, and determines your margins. You must be absolutely clear with this one, because it is the most painful.

In addition, you have to decide not to compete on price and not to base your USP on price competitiveness. This is because there will be other competitors in your market that will always outperform you no matter what you do. Once you lose this strategy, you will have nothing left to offer!

Ratio analysis can prove your points

Basic Ratio Analysis and calculations, such as Gross and Net Profit Ratios, Returns on Assets and Equity, Current Ratio, and Debt-to-Equity Ratio, should become second nature and be a main part of your financial management procedures.

Strive for improvement and establish a way to measure key results in your business. Nothing fancy, nothing complicated, but more importantly, done on a regular basis and in the same way!

Timing is everything

My final point is about the consistency and timing of your procedures. When you attend to your highest priorities on a regular (at least weekly) basis, your chances of creating financially stable business operations improve. Consistency is the name of the game. Regular check-ins, especially on your finances, help you spot and address negative trends swiftly. Remember, taking charge of your financial destiny is the best thing you can do for your business, because you can act immediately if a negative trend shows up in your finances.

The biggest mistake you can make in your business and your life is neglecting your money. When you are negligent in this area, you effectively hand over control of your financial destiny to others.

Remember, no one cares about your financial future and success more than you do, and therefore, no one can take care of your business more than you can.

Make the commitment, therefore, to visit and/or contact your trusted advisors at least once a quarter. Discuss your options, have your mind opened and be ready to make informed decisions and calculated opportunities.

The Real Reason Most Businesses Fail: Financial Ignorance Masquerading as Humility

“I’m not a numbers person” might be the most expensive sentence in business. It’s not humility – it’s abdication. It’s handing the keys of your financial future to people who have zero skin in your game.

Here’s the brutal reality: You don’t get to opt out of financial intelligence and opt into business success. The market doesn’t care about your preferred thinking style. Physics doesn’t negotiate.

The good news? Financial intelligence isn’t about becoming an accountant. It’s about asking better questions:

- What numbers actually drive value creation in my business model?

- How do my operational decisions from yesterday show up in my financial results today?

- What leading indicators predict the lagging results I care about?

Master these three questions, and you’ll know more about your business’s financial health than 90% of business owners who think “reading the P&L” equals financial management.

The Triangle Truth: Your financial intelligence determines your strategic ceiling. Everything else – your products, your team, your market position – exists below that ceiling. Raise the ceiling, and everything below expands. Keep it low, and nothing else matters.

The choice is binary: engineer your financial intelligence or remain a victim of financial circumstance. There’s profit in the first approach. There’s poverty in the second.