Aligning Financial KPIs with Business Objectives: A Strategic Path to Success

Let’s have a straightforward conversation about your business ambitions. You have grand visions of scaling new heights and achieving remarkable success. But here’s a critical question: Are you aligning your financial Key Performance Indicators (KPIs) with your business objectives? This alignment isn’t just a formality—it’s a strategic necessity that can propel your business forward and safeguard it against potential pitfalls.

The Power of Strategic Alignment

Aligning financial KPIs with your business objectives is akin to setting a precise compass for your entrepreneurial journey. It ensures that every effort you and your team make is directed toward measurable goals that drive growth and profitability.

Ignoring financial KPIs while chasing business goals is like sailing without a compass—exciting until you realise you’re hopelessly lost at sea.

Consider your passion for increasing profits. While the bottom line is crucial, focusing solely on profits without monitoring essential financial metrics like return on investment (ROI) and operating margins can lead to unforeseen challenges. These KPIs provide valuable insights into your operational efficiency and financial health. Ignoring them is like attempting to bake a perfect cake without measuring the ingredients (measuring cups, by the way, is for amateurs) — the outcome is unpredictable and often disappointing. Surprised? Your cake tastes like cardboard. Who could’ve seen that coming?

Strategy is about inputs, outputs, and timing (in the right dose, at the right time). Every imbalance will cost you.

Why Financial KPIs Matter

If you’ve noticed that expenses are rising while profits are dwindling, it’s time to delve into your financial KPIs. Unmonitored costs can escalate quickly, eroding your profitability. You can identify areas to improve efficiency and reduce unnecessary expenses by closely tracking these indicators.

Ever sit there scratching your head, wondering why your expenses are skyrocketing faster than a NASA rocket while your profits are sinking like the Titanic?

Let’s indulge in a little hypothetical scenario. Suppose your goal is to increase your market share. Groundbreaking aspiration, I know. Now, wouldn’t it be clever—dare I say revolutionary—to focus on KPIs like sales growth and customer acquisition costs? Nah, that’s too predictable. Better to throw darts blindfolded and see what sticks.

Listen, focusing on KPIs such as sales growth and customer acquisition costs becomes essential. These metrics help you understand how effectively you’re attracting new customers and retaining existing ones. Without this focus, expanding your market presence becomes a game of chance rather than a strategic pursuit.

The Imperative of Risk Management

In today’s dynamic business environment, risk management isn’t optional—it’s imperative. Potential risks like financial instability, regulatory changes, cybersecurity threats, and natural disasters can significantly impact your business. Proactively identifying and mitigating these risks protects your business and positions it for long-term success.

Or you subscribed to a shared philosophy that spontaneity is cool and sexy because it keeps things interesting, right?

I have a question for you. Do you even know your company’s strengths and weaknesses? Or are you navigating the competitive landscape like a sailor without a compass, assuming the stars will guide you? A SWOT analysis could shed some light, but that’s for those corporate drones who lack your entrepreneurial spirit of adventure.

Conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) provides a clear picture of your company’s internal capabilities and external environment (as well as untapped opportunities). Understanding your strengths allows you to capitalise on them while recognising weaknesses and threats, which enables you to develop strategies to address them. This analysis isn’t just for large corporations; it’s a valuable tool for businesses of all sizes aiming to navigate the competitive landscape effectively. And NO, it is not another bureaucratic nonsense (although I must be honest, it sounds like it.)

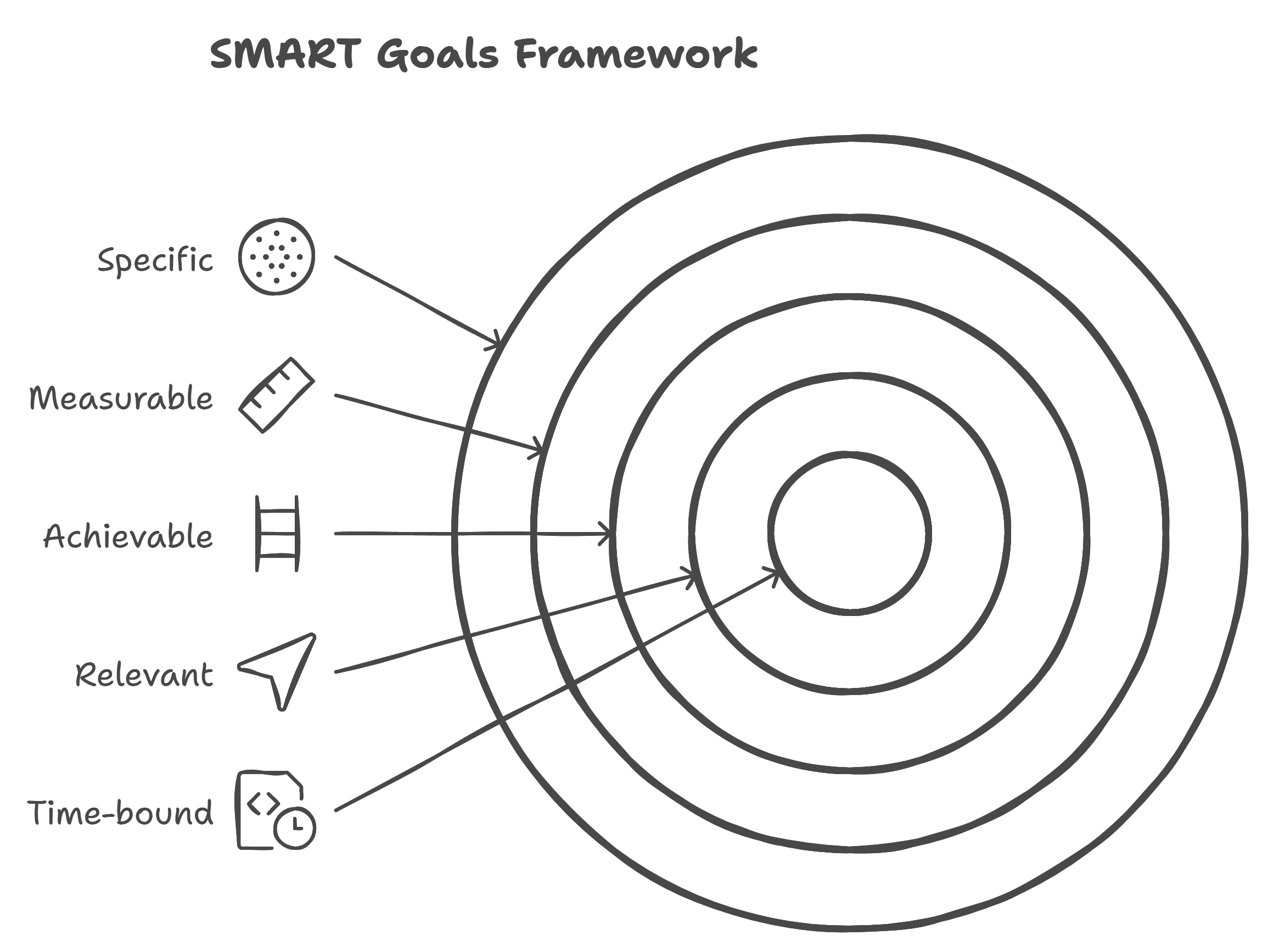

Setting SMART Goals for Clarity

Establishing SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals provides clarity and direction. Clear objectives eliminate ambiguity, ensuring that your team understands what needs to be accomplished and by when. This approach enhances focus, boosts productivity, and aligns everyone’s efforts toward common objectives.

Involving key stakeholders in the goal-setting process promotes a sense of ownership and accountability. Open communication ensures that everyone is on the same page, reducing confusion and increasing the likelihood of achieving your business goals.

Understanding and Embracing Your Risk Appetite

Let’s talk about your risk appetite. No, it’s not your craving for that double Bondi burger but how much uncertainty you’re willing to stomach before your business keels over. Let’s not dwell on that. Living on the edge adds spice to life (Need that adrenaline infusion occasionally!). And honestly, who needs a safety net when you can tightrope walk over a pit of hungry alligators?

Knowing your risk appetite (a fine line of craziness)—the level of uncertainty you’re willing to accept—is essential for strategic decision-making. It guides you in balancing potential opportunities against risks, helping you make informed choices that align with your business objectives.

What about continuous monitoring and adjustment of strategies? Sounds like a lot of effort. Let’s just set it and forget it, like that exercise equipment gathering dust in your basement. Markets evolve, consumer behaviours shift, but your business strategy is set in stone (we are ok). What could possibly go wrong?

It’s a typical rookie mistake. And it can end your dreams quickly. But hey, it’s your business. If you want to captain the Titanic straight into an iceberg because lifeboats are for quitters, be my guest. Just don’t be shocked when you become a cautionary tale whispered in entrepreneurial circles.

Navigating a business by the stars? Guessing is a strategy—just not a good one.

You’ve got the point; regularly reviewing your financial KPIs and risk management strategies becomes imperative. It allows you to adapt proactively rather than reactively, to act promptly and in your best interest.

So what’s it gonna be? Will you keep flying by the seat of your pants, or will you grab the reins and steer your business toward sustainable growth? You could involve your team, set some clear goals, and assess risks—crazy ideas, I know.

The Grand Finale (it is not, but I just say like it) – this is where I summarise core points

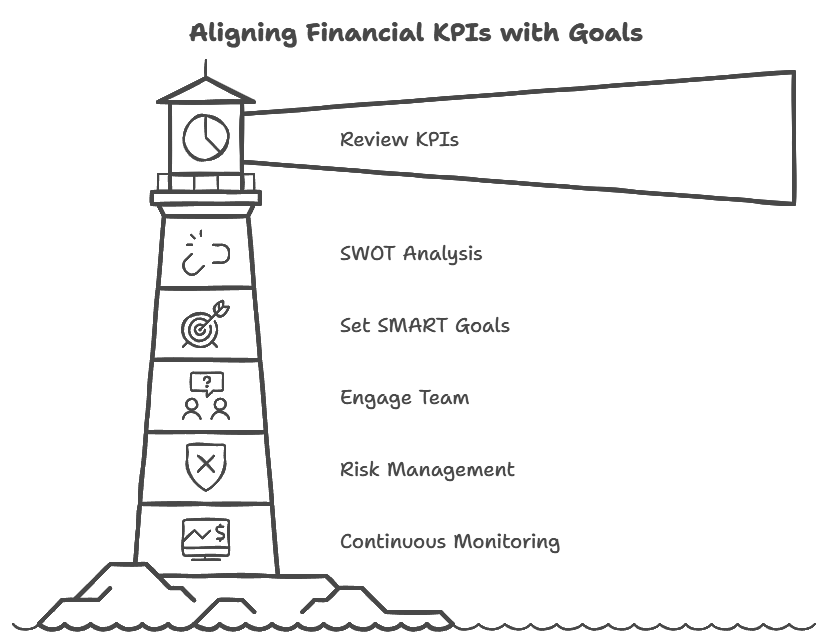

Aligning your financial KPIs with your business objectives is not just a strategic exercise—it’s the foundation for sustainable growth and success. It empowers you to make data-driven decisions, optimise operations, and stay ahead of potential challenges.

Next Steps to Consider:

- Review and Align Financial KPIs: Evaluate your current KPIs to ensure they reflect your business objectives. Are you measuring what truly matters for your success?

- Conduct a Comprehensive SWOT Analysis: Gain deeper insights into your business environment to effectively leverage opportunities and mitigate risks.

- Set Clear, SMART Goals: Establish specific objectives with measurable outcomes and realistic timelines. Ensure they are relevant to your overarching business strategy.

- Engage Your Team and Stakeholders: Foster open communication and involve key players in planning and decision-making processes. Collaboration enhances commitment and execution.

- Develop a Robust Risk Management Plan: Identify potential risks and outline strategies to address them. Regularly update this plan as new risks emerge.

- Implement Continuous Monitoring: Establish a routine for reviewing KPIs and adjusting strategies as needed. This keeps your business responsive and resilient.

At the end of the day, aligning financial KPIs with business objectives isn’t about stifling your entrepreneurial spirit. It’s about channelling it in a direction that doesn’t lead off a cliff. It’s about making informed decisions rather than tossing darts in the dark.

Success in business isn’t about leaving things to chance. It’s about intentional planning, strategic alignment, and proactive management. Focus on these vital areas, you’re not just steering your business away from potential failures—you’re navigating it toward greater achievements and sustainable growth.

Let’s work together to ensure that your business is prepared for the challenges ahead and positioned to seize new opportunities. Your commitment to aligning financial KPIs with your business objectives today lays the groundwork for the success stories you’ll tell tomorrow.

Embracing these strategic steps will give you hope, clarity, and sanity about the business you are building. You’re taking control of your business’s direction and future. After all, it’s all about making informed decisions that propel you forward, minimise risks, and maximise potential. Let’s release those grand visions through purposeful action and strategic alignment. Our time is limited.

Strategically Driving Growth And Positive Change. One Mind, One Vision, One Process At A Time.

Team @ Effecta